Net Collection Percentage

Monthly financial reporting can be a simple as a one page Excel document to as complicated as a large packet of information. With either option, it can be hard to know which numbers are really important and what the metrics are telling you about the health of your practice. It’s important to note that one metric is not enough to judge the effectiveness of the revenue cycle process. Because of the intricacies of the billing and collection process, it often takes several metrics to alert you to issues within the cycle.

Combined, those metrics can tell you where to dig deeper and how to track the problem to resolution. The three metrics we recommend looking at monthly are: net collection percentage and gross collection percentage; days in accounts receivable; accounts receivable charges, payments and adjustments.

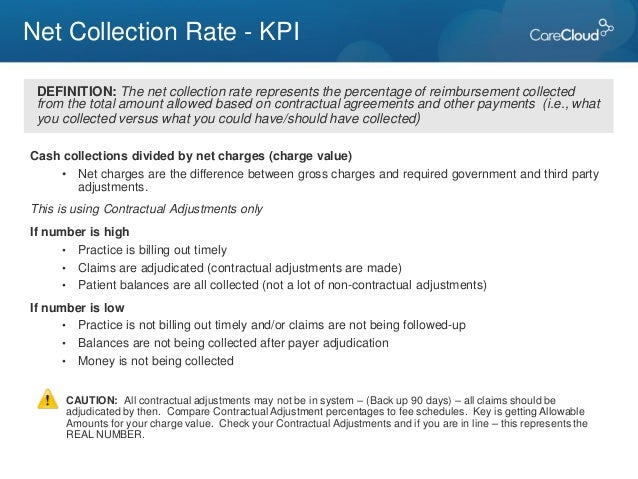

In this article, we are going to focus on net collection percentage and gross collection percentage. Monthly Metric 1 Net collection percentage represents the amount collected out of the total dollars expected to be collected. This formula works well if you are confident that the payment posting process also takes into account the allowable or contracted amounts from insurance companies. If so, this will also tell you how much revenue is lost due to factors such as collection accounts, untimely filing and other non-contractual adjustments The formula for net collection percentage is: Net Collection = Payments Percentage (Charges – Contractual Adjustments) The Medical Group Management Association (MGMA) recommends a net collection ratio of 95% or higher. If your percentage over a 6 or 12 month period is below 95%, it could mean that there is room for improvement in your revenue cycle. This metric can be influenced by timing of charges and payment posting so it’s not as telling on a month by month basis but, over a 3, 6 and 12 month basis, it helps to identify collection or payment issues.

Feb 15, 2010 - The net collection rate will tell you what percentage of your collectable revenue you are actually collecting. Please note that net charges are calculated by subtracting contractual write-offs, write-offs and adjustments from gross charges. [Gross Charges – Total Write-Offs and Adjustments = Net Charges. Jun 22, 2017 - While not the only means of evaluating a provider's revenue cycle, the net collection percentage, or NCP, can directly impact the level of financial support, if any, received by a provider under an arrangement with a health system. The KPIs are net days in accounts receivable (A/R), cash collection as a percentage of net patient services revenue, claim denial rate, final denial write-off as a percentage of net patient service revenue, and cost to collect.

Gross collection percentage tells you the payments you are collecting vs. Your charges for services that month. This metric does not include contractual adjustments. Gross collection percentage can be a valuable metric if you are looking for an understanding of your charges and how they compare to your contracted rates. It is highly influenced by payer mix and the timing of charges so it’s important to also review this metric over a 3, 6 and 12 month time frame.

The formula for net collection percentage is: Gross Collection = Payments Percentage Charges Because of the wide variety of methodologies for setting fee schedules or chargemasters and payer mix, there is no “recommendation” by the MGMA on this metric. However, if your chargemaster is set to 200% of Medicare allowable, then an acceptable range for gross collection percentage would be between 40% and 60%. If you are higher than that, it means that your payer mix if good (less Medicare and Medicaid) or your charges are set closer to the contracted rates of the payers. If you are lower than that, it may mean that your fee schedule is set higher than the allowed amount or that you have a charge lag. Lower than average collection percentages over a 6 or 12 month period along with a 90% to 100% net collection percentage could mean that there are unusual or unnecessary write offs/adjustments being taken.

DEFINITION of 'Net Collections' A term used in medical accounting to describe the amount of money collected on the agreed-upon fees charged. Net collections are usually lower than net charges (the total amount the provider agrees to accept as payment) and it is certainly lower than gross charges (the provider’s total amounts before insurance adjustments and other adjustments). The net collections rate is calculated by dividing payments received from insurers and patients by payments agreed upon with insurers and patients. A medical practice reports its net collections on the along with gross charges, net charges and the gross collection rate. BREAKING DOWN 'Net Collections' Many factors affect how much a medical practice actually collects compared to how much it would like to collect in an ideal world. To start with, several factors lower gross collections. For example, insurance companies may not pay the doctor’s full fee; doctors typically agree to limit their fees to scheduled amounts under their agreements with companies.

Net Collection Percentage

In addition, some patients will not pay their bills in full or at all, so the practice will never receive the total amounts owed from those patients. Also, a provider’s billing staff might cause the practice to lose money by not filing claims by the deadline, and insurers may deny some claims that aren’t covered. Suppose a medical practice’s annual invoices totaled $1 million. That sum would represent its gross charges. The amount the practice actually receives after sending the invoices to its patients and their insurance companies might be $800,000; this is the practice’s net collections. One way medical practices can analyze their performance is to look at their net collections.

Typical payers include, private health insurance and individual patients. If a medical practice saw that its net collections were unacceptably low for one of these categories, it might stop accepting those patients or start requiring those patients to pay up front before seeing a doctor or having any tests or procedures performed.